In yet another rebuke of Groupon’s (GRPN) accounting methods, Anthony Catanach drew attention to the intangible assets sitting on Groupon’s balance sheet. Whilst he noted the danger of Groupon’s high intangible assets, it is so serious that it warrants a more in-depth analysis.

Intangible assets encompass a wide variety of non-physical assets such as patents and goodwill; however, unlike physical assets, such as cash or equipment, they exist only on paper and so are difficult to value. The valuation of intangibles therefore relies heavily on the estimates and judgment of the company – and Groupon has a less than stellar record in its accounting and reporting.

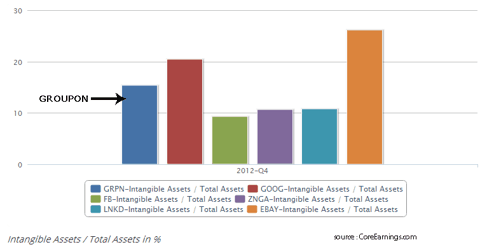

At first glance, the picture is not too awful – Groupon’s intangible assets account for 15% of it total assets.

As shown above, Groupon’s proportion of intangible assets appears roughly inline with its peers. Google (GOOG) and eBay (EBAY) both have higher percentages of intangibles (at 20% and 26%, respectively) whilst Linked In (LNKD) and Zynga (ZNGA) are both lower at just over 10%.

Things begin to get scary when reviewing what the intangible assets comprise. Google has a pile of online-pharmacy.org valuable patents (many from its Motorola acquisition) and eBay has some prime acquisitions such as GSI Commerce. Groupon’s intangible assets, by contrast, are far less compelling.

The largest chunk of Groupon’s intangibles is Goodwill, which accounts for $207 million of the $310 million total. Goodwill is created when another company is purchased (technically it is the excess of the amount paid for the company above its net asset value). However, Goodwill can only continue to be carried on the balance sheet so long as its value is not substantially impaired. If the current value is substantially lower, then it should be written off against profits. This is exactly what happened to HP (HPQ) with the write-down of its Automony purchase. The companies Groupon purchased were primarily in the “daily deals” space, and we need only look at the share price of Groupon and the travails of Living Social to gauge how well daily deals businesses are faring. It is therefore a very reasonable conclusion that the goodwill on Groupon’s balance sheet could be ripe for a write-down.

Next up is deferred tax assets of 85 million. These are strange accounting curiosities, the validity of which is an ongoing debate. But one thing is for sure, a deferred tax asset is only useful if a company will generate substantial profits (in which circumstance the deferred tax asset can offset a future tax charge). Groupon, having failed to generate any profit to date, is a pretty poor candidate for having what amounts to a profits tax credit sitting on its balance sheet.

Finally, “other intangibles: of $43 million. For a tech company this would normally include patents and developed technologies; however, Groupon, with a zero research and development expense, is not a technology company. As such, there are some curious items in here – “subscriber relationships” of $21 million and “developed technology” of $11 million. Given the rapid decline of the daily deals business, the subscriber relationships are unlikely to have a significant value (let alone the value Groupon ascribes to them); the developed technology is equally dubious, given Groupon’s zero R&D.

We have seen what substantial write-downs can do to the profitability of a company like Microsoft (MSFT) or the share price of HP. What, then, a major write-down would do to a struggling company like Groupon, which has yet to turn a profit, its rather ominous.